Battery has been expanding its industrial technology & life science tools (ITLST) practice over the past two decades, with the team completing more than 95 investments in that period.

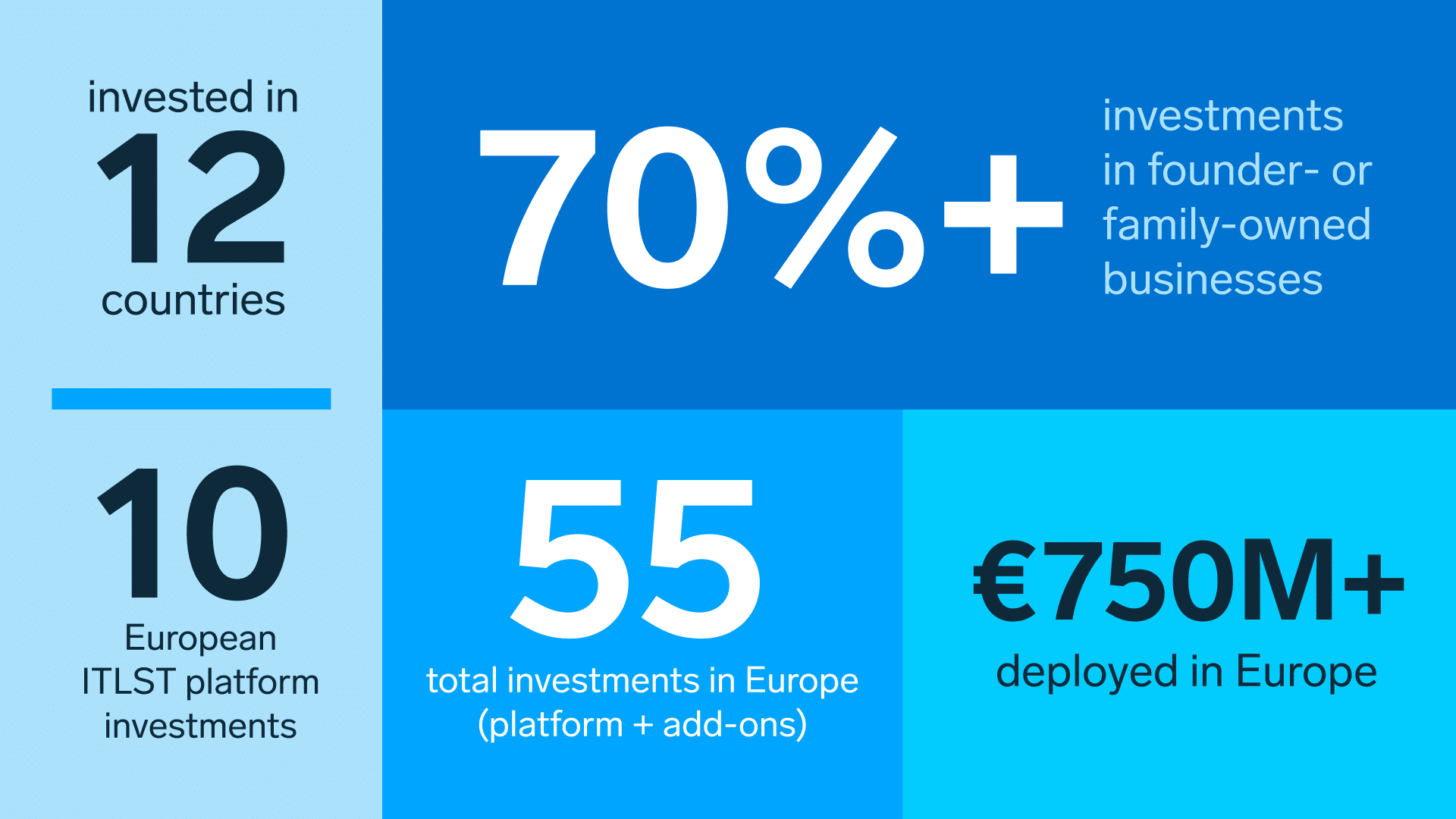

Interestingly, more than half of those investments have been in European-headquartered businesses—and, despite the volatile macroeconomic climate globally, we see a strong opportunity to fund many more European businesses in the future.

As Battery looks to increase its investment activity in Europe, and better support its existing portfolio in the region, we are bolstering our on-the-ground, ITLST presence in London. Stefan Momic, one of our vice presidents, recently relocated to London to better support our European activity and is leading recruitment efforts to build out a local investment team in Europe.

Why Europe?

In our experience, the region has consistently proven to be a very fertile ground for innovation in industrial tech and life-science tools. Europe has a deep-rooted culture of high-end technology addressing critical trends – from meeting new environmental regulations spurred by climate change and concerns about contaminants like PFAS (“forever chemicals”), to increasing automation to address labor shortages, to contributing to scientific research at the forefront of fighting global diseases.

European ITLST companies are also, we believe, well-aligned with the value Battery can provide. Most of the businesses we back in countries like Germany, the Netherlands and the U.K., among others, are decades old and most often, family- or management-owned. Often, they’re venerable national champions who realize that to continue growing, they need to start competing outside their home market, which brings a new suite of challenges as they look to flourish in an increasingly globalized world.

Specifically, these companies may see the need to expand into new geographies or business sectors; up-level their management teams across locations; upgrade technology systems; or increase R&D investment to develop new products and grow organically. Battery offers support in all these areas and offers family- and management-owned businesses a different path for the business and its employees rather than selling out to larger companies. Additionally, Battery helps with the identification, origination and execution of add-on acquisitions that complement and often accelerate organic growth initiatives.

Many of these companies operate in niche markets, but they frequently make critical, often under-the-radar, technology to enable solutions in important areas like food and water safety, medical innovation and next-generation industrial safety, to name a few. Our most recent European ITLST investments, for example, are steute*, a founder-owned provider of switches and sensors for critical medical and industrial-safety applications, and Skalar Analytical*, a management-owned provider of automated laboratory analyzers for environmental, food & beverage and energy applications.

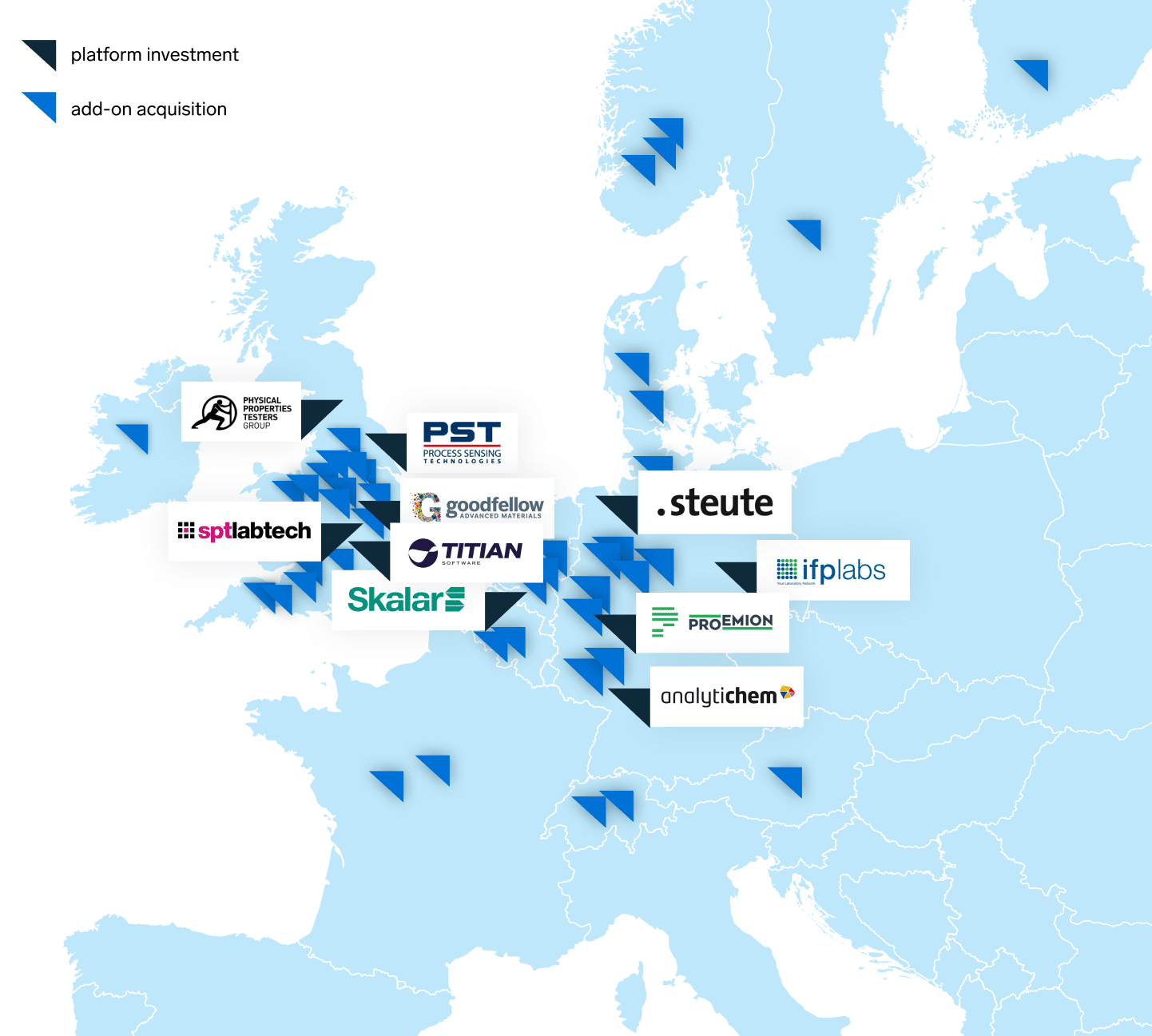

Our European footprint

In Europe to date, our ITLST practice has invested in 10 “platform” companies, and 55 total companies including add-ons since 2003 across 12 different countries, deploying more than EUR 750 million in capital.

Spotlight: Laboratory tech

Our investment approach is very thesis-driven and thematic. As an example, the “laboratory tech” space is one sector we’ve focused on, with our flexible mandate allowing us to partner with a wide range of companies serving laboratory customers. Since 2018, we’ve backed European companies across a variety of different business models in this sector, including instrumentation (SPT Labtech* and Skalar*), consumables (AnalytiChem*), services (ifp Labs*) and software (Titian Software*). Skalar*, Bernd Kraft* (starting point for AnalytiChem*), ifp* and Titian* were all founder- or management-owned businesses.

Our strategy for each of these businesses includes continued investment in organic growth initiatives, plus a healthy mix of add-on acquisitions. At Skalar, for example, we helped the management team identify and execute five complementary founder-owned add-on acquisitions expanding Skalar’s geographic footprint in North America (EST Analytical* and PromoChrom*) and Asia (GERSTEL*’s Japanese and Chinese subsidiaries), while continuing to strengthen Skalar’s European footprint (GERSTEL*, TE Instruments* and LCTech*). On the organic-growth side, having a global sales channel provides accelerated expansion opportunities for all brands. Additionally, we are supporting numerous new product-development efforts at the company, particularly around software and consumables as we look to increase high-quality revenue. We’ve followed a similar global acquisition strategy with Germany-based AnalytiChem, completing seven add-on acquisitions across six countries – Belgium, the Netherlands, the UK, Canada, USA and Australia – in a little over two years.

In contrast, our strategy for ifp Labs is much more regionalized, focused solely on the pan-European market. To that end, our M&A efforts have been more focused on Europe, with one of our acquisitions expanding ifp’s capabilities in the water testing space, while the other three acquisitions expanded our food quality laboratory network in the UK. All seven add-ons at AnalytiChem and all four add-ons at ifp Labs were family- or founder-owned as well.

Our strategy and approach is not one-size-fits-all; it is highly tailored to the specific circumstances and desires of a given company’s management team. We believe our experience with family- and management-owned businesses across a wide range of geographies, business models and end-markets provide a strong foundation for us to support our companies.

The road ahead

We continue to be excited about the investment opportunities in Europe across a wide range of industrial tech and life science tools markets. The market overall continues to be highly segmented, with domestic champions on the cusp of turning into global and pan-European leaders through acquisitions and organic growth. We are excited to support these innovative companies through the next phase of their growth journey—please feel free to get in touch if you would like to speak with us.

The information contained here is based solely on the opinions of Jesse Feldman, Zack Smotherman, Justin Rosner and Stefan Momic, and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The views expressed here are solely those of the author.

*Denotes a Battery portfolio company. For a full list of all investments and exits, click here.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this publication are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.