Israel’s story as the Startup Nation is well-known. What’s less understood is the degree to which Israeli technology founders punch above their weight when it comes to serial entrepreneurship. The Israeli tech ecosystem has evolved over time, from a culture of experimentation into one of compounding experience—one in which founders who build, scale, and then build again are becoming the norm, and are creating notable value for investors and other ecosystem stakeholders despite the region’s geopolitical hurdles.

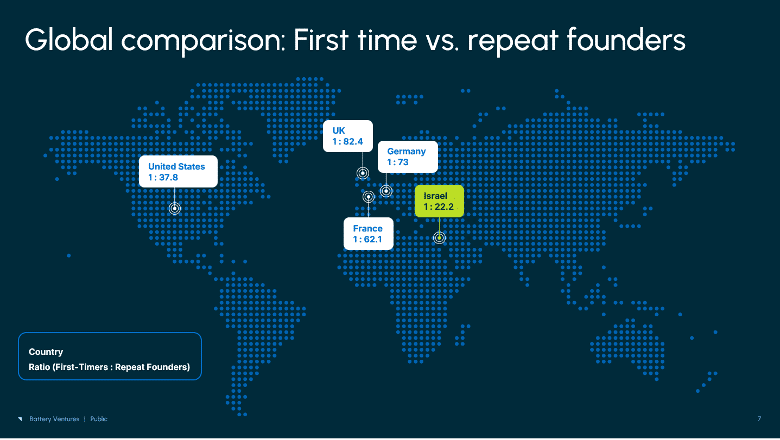

Exclusive data from dealigence, recently commissioned by Battery Ventures and HSBC, found that one in every 22 early-stage Israeli startups is now led by a repeat founder, the highest ratio in the world. Israel’s serial founders account for nearly 10 percent of all early-stage, serial founder-led companies globally, despite the country representing less than 0.1 percent of the world’s population.

The Next Phase of the Startup Nation

Israel’s repeat entrepreneurs are also scaling. Among companies with between $50 million and $200 million in total funding, Israel ranks second worldwide, with one in every 7.7 companies in this group led by a repeat entrepreneur.

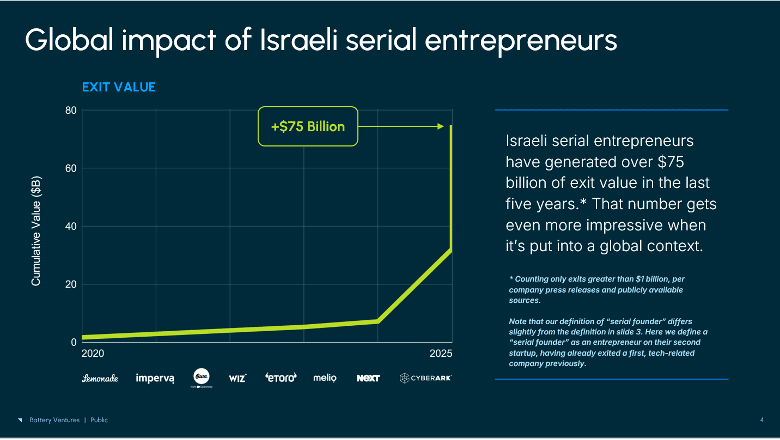

This density of experience has real economic impact. Over the last five years, Israeli serial founders have created more than $75 billion in exits, according to dealigence1.

These entrepreneurs are, in our view, a special breed, and we feel they’re particularly suited to succeed in today’s fast-moving tech environment, now marked by huge disruption created by AI. While the bulk of our investments continue to go to first-time founders, we realize that serial entrepreneurs often have a leg up because they have already navigated fundraising, scaled teams across borders, and managed growth through volatility.

That repetition isn’t redundancy; it’s refinement. Every successful company, in some form or another, seeds the next one. Every founder who scales a business reinvests time, capital, and conviction back into the system. The result is a flywheel of talent and trust that now defines Israel’s competitive edge.

And crucially, this is not a story of serial founders replacing first-time ones. The opposite is true. The two groups reinforce each other, forming a self-sustaining loop of innovation. First-time founders are standing on the shoulders of those who came before them. The presence of experienced entrepreneurs accelerates learning for the next wave of builders, helping first-timers move faster, avoid common pitfalls, and aim higher from day one. We feel this dynamic is pivotal in making Israel’s startup ecosystem more mature and its companies more ambitious with each generation.

Why the Model Works

Several forces make Israel unusually good at turning experience into momentum.

A steady cadence of exits keeps liquidity and learning circulating. Each outcome adds new mentors, angels, and experienced operators to the mix, deepening the country’s collective expertise. Then there’s the national bias toward urgency and iteration, meaning decisions get made quickly, progress beats perfection, and execution often outruns deliberation. And perhaps most important, founders here don’t fear failure. It’s treated as a stage in the journey, not the end of one. Lessons learned from a first company often power the success of the second or third.

The result is a system that’s fast-moving and deeply interconnected. Founders learn quickly, capital recycles rapidly, and talent stays in the ecosystem rather than leaving it.

The Compounding Dynamic

In venture, experience compounds just like returns. Founders who have built before tend to raise faster, hire smarter, and navigate scaling challenges with greater precision. They’ve seen the cycles, they know when to hold steady and when to sprint.

At Battery, we have made 20 investments to date into Israeli companies founded by at least one serial entrepreneur—companies in industries ranging from cybersecurity to fintech to semiconductors to HR software and more. Relationships are the lifeblood of our business, and it’s clear that Israeli founders know this, too: They feed their knowledge, networks, and opportunities back into the ecosystem. First-time entrepreneurs bring fresh ideas and bold risk-taking, repeat founders bring structure and context. Together, they create one of the most efficient and resilient innovation networks in the world.

That balance shows up in the market data. Israel’s repeat founders accounted for more than 7 percent of all global early-growth companies led by serial entrepreneurs, outpacing countries with ten times its population. And in a period of global uncertainty, Israeli serial founders continued to raise large rounds, a sign that investors are rewarding proven execution over noise.

At Battery, we’ve seen this dynamic firsthand. We continue to back new entrepreneurs as well as second-time founders who are leveraging prior experience to build even more ambitious, globally minded companies, a reflection of how far Israel’s startup ecosystem has come and how much further it can go.

Download PDF

Loading...

Loading...

The information contained in this market commentary is based solely on the opinions of Barak Schoster and Nikki Hassan, and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The views expressed here are solely those of the authors.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this publication are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.

* Denotes a Battery portfolio investment. For a full list of all Battery investments, click here

1. Only counting exits publicly reported as greater than or equal to $1B

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.