Defense tech is hot right now. And we think the hype is warranted.

We believe that the growing Department of Defense budget ($863B in FY24) can support multiple venture-scale outcomes; that key modernization initiatives have laid the foundation for tech transformation; and that the growing number and influence of innovation units inside the DoD, along with startup-friendly policy precedents, will propel startups to fill the vacuum of modern technology in the DoD. More recently, the DoD has shown strong initiative to drive efficiency through technology which will require the Department to work hand-in-hand with Silicon Valley. In fact, the DoD has proactively called out areas it is looking to prioritize—which therefore maps closely to our key investment themes—including in modern infrastructure, operationalizing data and AI and autonomous systems.

To understand where defense tech is headed, we need to understand how we got here. In this post, we’ll share why we’re excited about defense tech, frameworks we use to understand the landscape and themes we find the most compelling. Additionally, we’re sharing a more in-depth presentation that has guided our thinking on defense internally at Battery Ventures.

Framing the opportunity

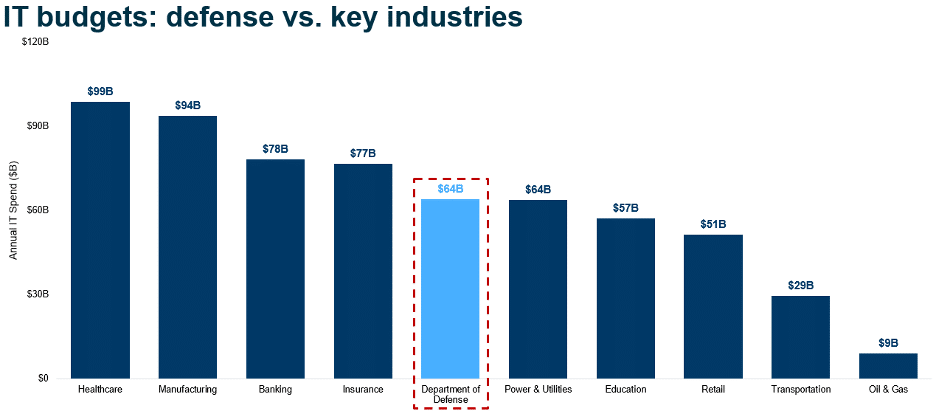

The opportunity is clear: the DoD has a ginormous budget ($863B in FY24) and spends billions per year on IT alone ($64B in FY24). This level of IT spend has already eclipsed other major American industries like retail ($51B) and transportation ($29B) and approaches others like insurance ($77B) and banking ($78B) (source: Gartner). Moreover, the defense budget is likely to increase in the next National Defense Authorization Act (NDAA) by $150B to ~$1T, which is making its way through the Senate at time of writing.

Note: Defense metric represents the DoD’s 2025 budget request for information technology and cyberspace activities. Industry vertical metrics represent Gartner estimates for 2024 total enterprise IT spend, excluding spend on consulting and business process services. Source: U.S. DoD 2025 Budget Request, Gartner

Note: Defense metric represents the DoD’s 2025 budget request for information technology and cyberspace activities. Industry vertical metrics represent Gartner estimates for 2024 total enterprise IT spend, excluding spend on consulting and business process services. Source: U.S. DoD 2025 Budget Request, Gartner

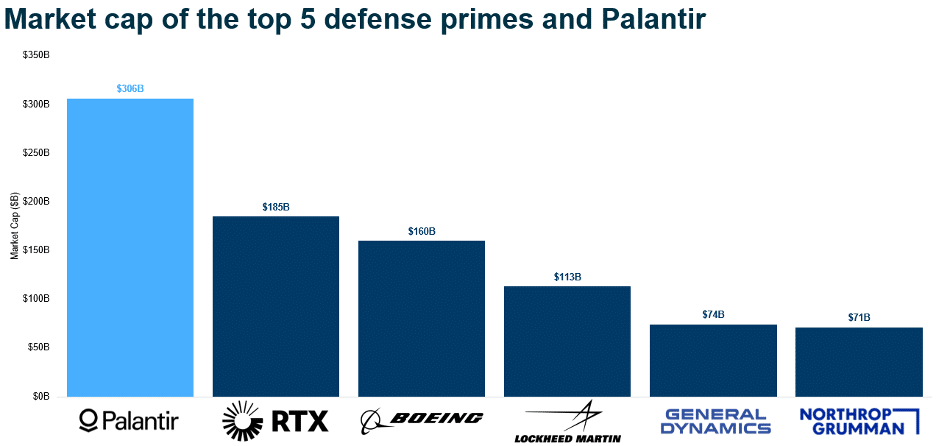

With its massive budget, the DoD effectively created the dominant prime contractors—RTX, Lockheed Martin, Boeing, General Dynamics and Northrop Gruman—whose collective market cap exceeds $500B (source: Capital IQ). However, these prime contractors, all founded in the early-to-mid-1900s, have become deeply entrenched, leading to lackluster innovation.

But the status quo is changing fast. Over the last decade, we’ve seen the remarkable success of a new cohort of companies targeting the DoD as their primary buyers, namely Palantir, Anduril and SpaceX. Palantir, now the largest ‘prime’ by market cap (~$300B), became the first new defense contractor to join the S&P 500 in the last 46 years. These successes have both demonstrated to the DoD the value of embracing new technology and forged a path for the many new defense startups we’re seeing today.

Source: Capital IQ as of 06/04/2025

Source: Capital IQ as of 06/04/2025

Why the tide has turned

The DoD appears not only aware of its need to modernize but is actively investing in doing so. Many view heightened foreign adversary competition as the main driver, but this overlooks a simpler explanation: The DoD and our warfighters recognize how far behind their technology is.

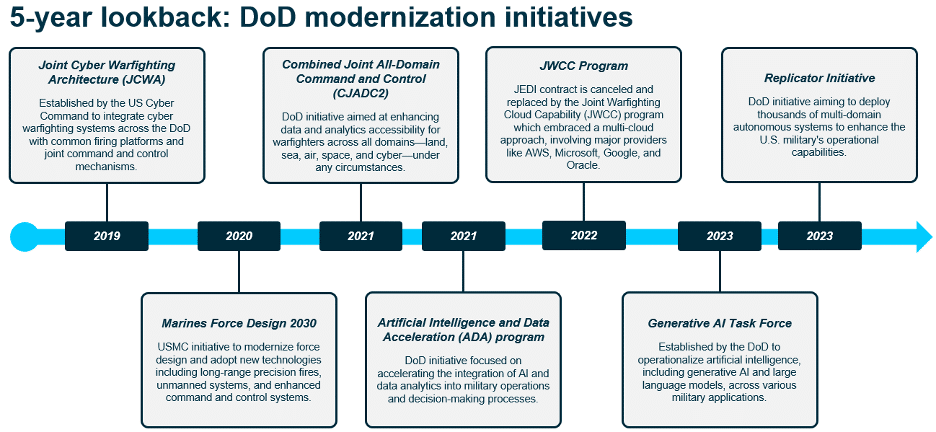

For example: cloud adoption. Cloud migration has been on the roadmap for the DoD since 2012. After a decade of delays and hiccups (e.g. the JEDI lawsuit and subsequent cancellation), the Joint Warfighting Cloud Capability (JWCC) program made strides in 2022 with a multi-cloud approach powered by Amazon, Microsoft, Google and Oracle. Meanwhile in the civilian world, 90% of enterprises were already using cloud technologies before JWCC was even created.

Another example is drone technology. Many view the Ukraine war as the first modern war given that both sides are technically advanced. We’ve seen high-volume, low-cost drones win out over exquisite and expensive systems that are more limited in quantity.

Over the last five years the DoD has established several initiatives to modernize its technology, which we view as a strong signal of its desire to enable and accelerate comprehensive tech transformation.

Source: JCWA, Marines Force Design, CJADC2, ADA, JWCC, Generative AI Task Force, Replicator Initiative

Source: JCWA, Marines Force Design, CJADC2, ADA, JWCC, Generative AI Task Force, Replicator Initiative

Heading into the current Trump Administration, initiatives have accelerated and made their way further into both policy and application. In December 2024, Chairman of the Senate Armed Services Committee Roger Wicker introduced his FORGED Act which would reshape DoD acquisition to compress acquisition timelines, empower users to be decision makers, and strengthen America’s industrial base generally. In March 2025, Secretary of Defense Pete Hegseth released his Modern Software Acquisition and Modernizing Defense Acquisitions memos, each with similar goals to the proposed FORGED Act, with the former memo focused specifically on breaking down barriers to put software into the hands of military personnel.TT

These initiatives and others power the DoD’s mission to advance battle management, improve logistics, deliver autonomous capabilities and fulfill the potential of technology adoption.

The foundation is set

How might these initiatives translate into practical business opportunities for commercial companies? We see two core drivers laying the foundation for the DoD to work with younger companies to deliver the technology it so desperately needs.

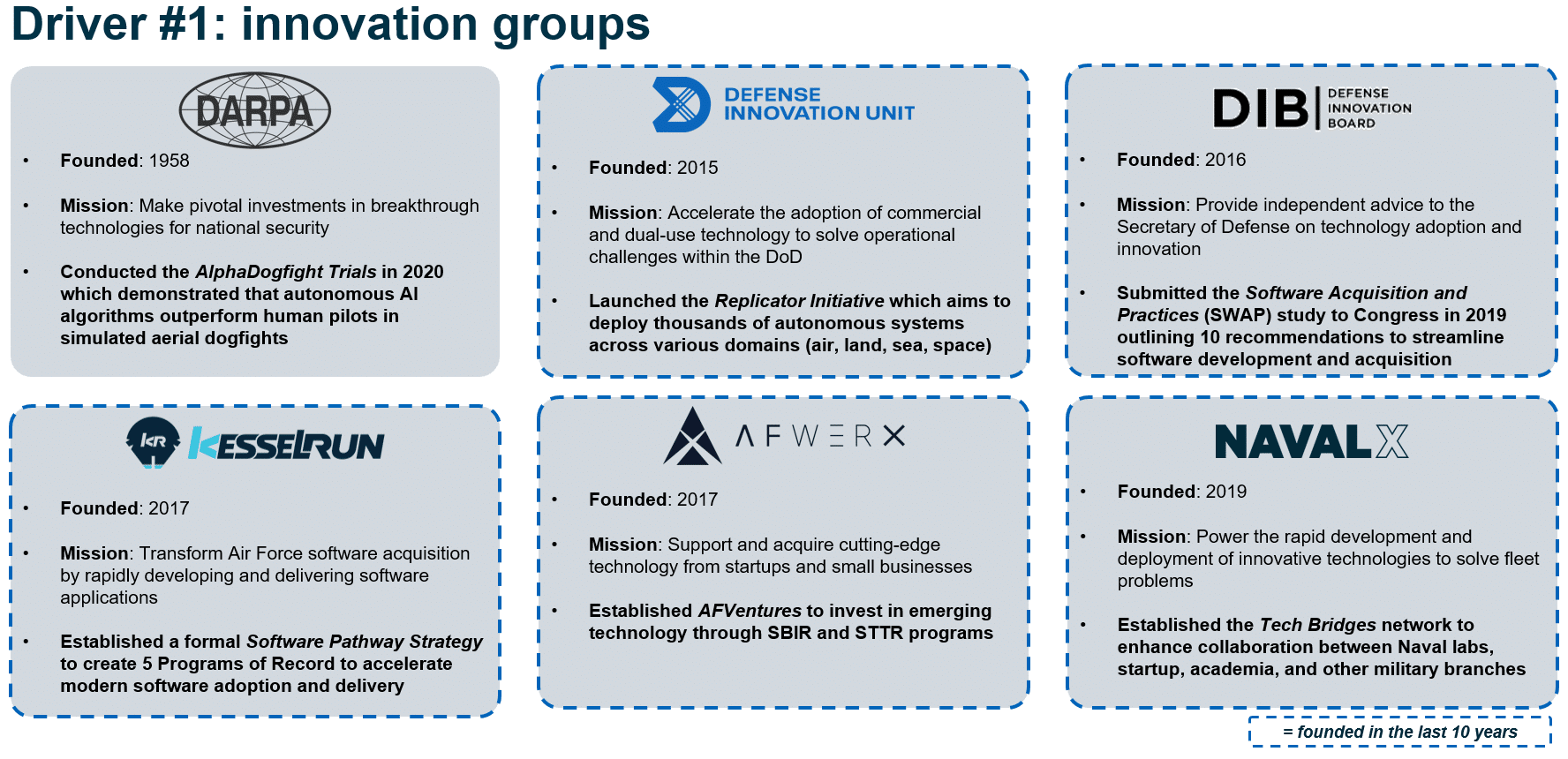

First, DoD innovation groups have proliferated over the last decade, specifically designed to support and acquire innovative technologies. Unlike Program Executive Offices (PEOs), these innovation units are tasked with finding innovative technologies that can play a crucial role in future capabilities, even if they aren’t fully developed and productized for battlefield use today. There are so many innovation units now—over 100!—that rumors now suggest the Trump Administration is looking to consolidate them to maximize efficiency. Notably, we’ve also seen the rise of non-DoD groups looking to build bridges between modern technology and warfighters including the House Defense Modernization Caucus led by Rob Whitman and Pat Ryan, the Reagan National Security Innovation Base Summit from the Ronald Reagan Institute, and the Silicon Valley Defense Group.

It’s worth calling out an important contribution DARPA made to the DoD, which was the introduction of Other Transaction Agreements (OTAs). These flexible contracting vehicles substantially compress the time it takes for the DoD to onboard new vendors. In recent years, OTA use has grown and now underpins much of the newer DoD technology adoption.

Source: Defense Innovation Unit, AFWERX, KesselRun, NavalX, DARPA, Defense Innovation Board, Air Force Life Cycle Management Center, Johns Hopkins Applied Physics Laboratory

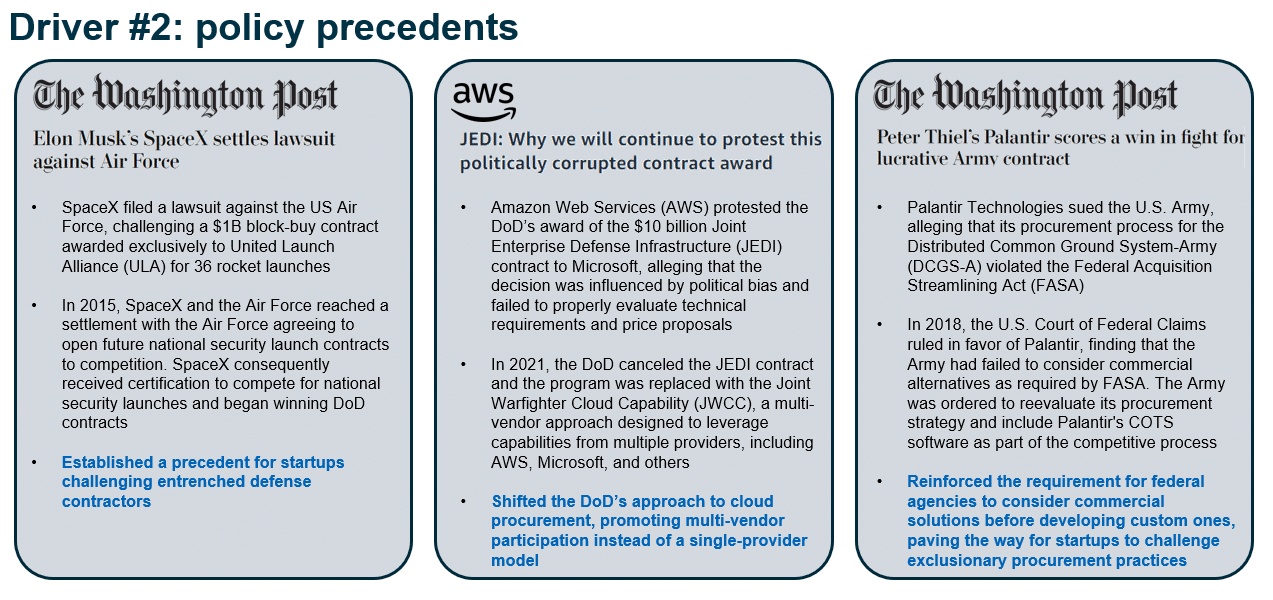

Second, important policy precedents have been set that promote new vendor consideration in DoD procurement and ‘buy vs. build’ decisions—namely, SpaceX’s 2015 suit against the USAF, Palantir’s 2018 suit against the U.S. Army and the cancellation of the JEDI program which was replaced with JWCC. U.S. Code’s Preference for Commercial Items (Section 2377 of Title 10), part of the 1994 Federal Acquisition Streamlining Act (FASA), requires the DoD to evaluate commercial solutions before building in-house systems and was, importantly, reinforced by Palantir’s successful suit against the Army in 2018. More recently, Secretary of Defense Pete Hegseth has cited the importance of this law to the services when looking to procure new technology.

Source: U.S. DoD, The Washington Post

All of these precedents support competition from new vendors in the defense market. Perhaps no contract better exemplifies this progress than the $260M Program of Record deal recently won by Red Cat, a decade-old drone manufacturer based in Utah, relatively unknown at the time, to deliver approximately 6,000 drones to the Army.

Importantly, the DoD already has a track record of working with third party vendors to execute on their goals. Last year, 58% of the DoD’s budget was spent on third-party vendors. While this spending has historically been services-oriented, we expect it to become increasingly software-oriented as the technical capabilities the DoD requires become more specialized and advanced.

Frameworks for the defense software landscape

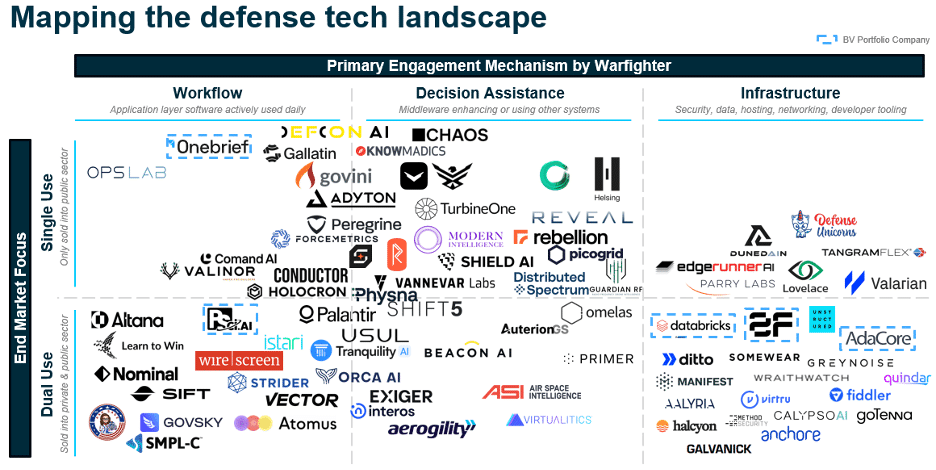

To distill the large and diverse defense-tech ecosystem, we use a categorization framework with two overarching criteria: end-market focus and user engagement mechanism.

End-market focus. Defense companies can be broadly bucketed into two categories:

- Single Use: These companies only sell their products only to government and defense.

- Dual Use: These companies sell their products primarily to government and defense but also the commercial sector.

User engagement mechanism. There are three primary ways users can engage with defense software:

- Workflow Execution: These products are most similar to application layer vertical software, which is designed as a system of record and execution for workflows.

- Data-Informed Decision Assistance: These products harness data from existing systems to inform decision-making and analysis.

- Infrastructure Support: These products are the core infrastructure that supports other applications and systems used by military personnel.

Here is a non-comprehensive view of the emerging defense software landscape based on these criteria. As you see below, AI can be embedded across the entire stack. Many infrastructure layer companies have been built to support AI applications; decision assistance platforms are leveraging computer vision for situational awareness; and many workflow applications are using LLMs to automate their end user’s “job to be done.”

For a full list of all Battery investments and exits, please click here.

For a full list of all Battery investments and exits, please click here.

Emerging themes in defense tech

We are focused on four emerging themes that map to the DoD’s technology modernization efforts Secretary Hegseth and others have laid out for the Department.

1. Modern Infrastructure

We believe it’s critical for the DoD to adopt modern infrastructure software to support modern applications and AI. This includes security, monitoring and observability, data and storage, foundation models as well as edge capabilities. One of the biggest unique challenges for DoD software adoption is that many defense use cases require maximal security, support for edge or air-gapped environments, or both.

On the security side, Wraithwatch provides AI systems that explore system vulnerabilities and attack strategies to develop proactive defensive security strategies. Another example is Second Front*, whose DevSecOps platform helps companies streamline the development and accreditation processes for software deployed into the DoD.

2. Operationalizing Data & AI

We believe that the DoD must adopt technologies that harness data across systems and enable the scalable deployment of AI for analysis, informed decision-making and automation. The DoD currently manages large amount of data of varying types (structured, unstructured, geospatial, time series, etc.) that are cross-department and cross-application. In order to effectively leverage this data and realize the potential of AI, new systems will be required.

For example, Vannevar Labs analyzes large volumes of cross-language data from multiple sources (first-party reconnaissance data, open source data streams, etc.) to help the DoD analyze and assess threats. Another example is Shift5, which elegantly extracts messy data from legacy hardware systems, transforms it and runs an observability stack over the data for cybersecurity, predictive maintenance and other purposes.

3. Autonomous Systems

Autonomous technologies have the potential to become the future of advanced warfare due to their increased safety and risk mitigation, cost efficiency and enhanced operational effectiveness. The DoD has signaled its interest in and focus on autonomous technologies through several initiatives like the Unmanned Systems Roadmap, the Replicator Initiative (2023), and the Marines Force Design 2030. We believe companies that facilitate the operation of autonomous systems—whether through system interoperability, multi-modal data integration capabilities, human-machine interaction systems or edge compute capabilities—will be critical for this transformation.

As an example, PicoGrid provides a unified platform to connect data, command and control autonomous systems and sensors at scale.

4. Workflow & Applications

Lastly, we believe that the DoD currently utilizes legacy software, in-house builds or manual processes for many workflows that can be significantly streamlined with modern software, much like what we have seen in enterprise software over the last 20 years.

One vector of this theme is replacing legacy in-house builds—for example, OpsLab provides an asset management platform for the Air Force to oversee its aerial fleet, replacing the use of a decades-old homegrown solution that is maintained by outsourced contractors.

Another vector is replacing horizontal solutions with verticalized software purpose-built for defense. For example, OneBrief*, a company providing collaborative mission planning software used across the chain of command, is replacing the use of PowerPoint and Word documents, enabling the DoD to work collaboratively and more efficiently.

Battery is excited to support the defense tech ecosystem

We’re very excited about the innovation happening in defense and the market tailwinds we think will accelerate it. Battery is no stranger to defense technology. We made our first defense-related investment in Insitu*, an early pioneer in small tactical unmanned aircraft vehicles. Founded in 1994, the firm was subsequently acquired by Boeing in 2008. More recently, in 2024, we announced our Series C investment in Second Front*, a company helping software companies accredit, deploy and monitor software onto DoD networks, and last week announced our investment in Onebrief*, which is helping to accelerate military planning by enhancing collaboration.

If you are a founder building the next big defense tech software company, email michael@battery.com and aneil@battery.com. We would love to chat.

You can also download our full defense tech thesis presentation, outlining why we are excited about defense tech, frameworks for investing and Battery’s expertise in the space here:

The information contained herein is based solely on the opinions of Michael Brown and Aaron Neil, and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The views expressed here are solely those of the authors.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this publication are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.

*Denotes a Battery portfolio company. For a full list of all Battery investments and exits, please click here.

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.